There’s no pat answer to the question, “How much is travel insurance?” However, it’s easy to understand the factors that go into the premium you pay.

Chapter 3: How Much Is Travel Insurance?

How Much Does Travel Insurance Cost?

Travel insurance typically costs 5 to 10 percent of your total trip cost, though that amount can be influenced by several factors, including:

- Your age

- How much you're spending on your trip

- The amount of coverage you're choosing

- The number of people covered under your policy

And some plans may even factor into the price:

- How far out you are from leaving

- How many days you are traveling

Your Price Depends On The Element Of Risk

When figuring out how much travel insurance costs, remember the price you pay depends in large part on how large of a trip investment you are making – your trip cost!

Age, trip cost, plan type, number of travelers, and for some plans destination and trip length: all these factors can help determine risk, and often determine the cost of your policy.

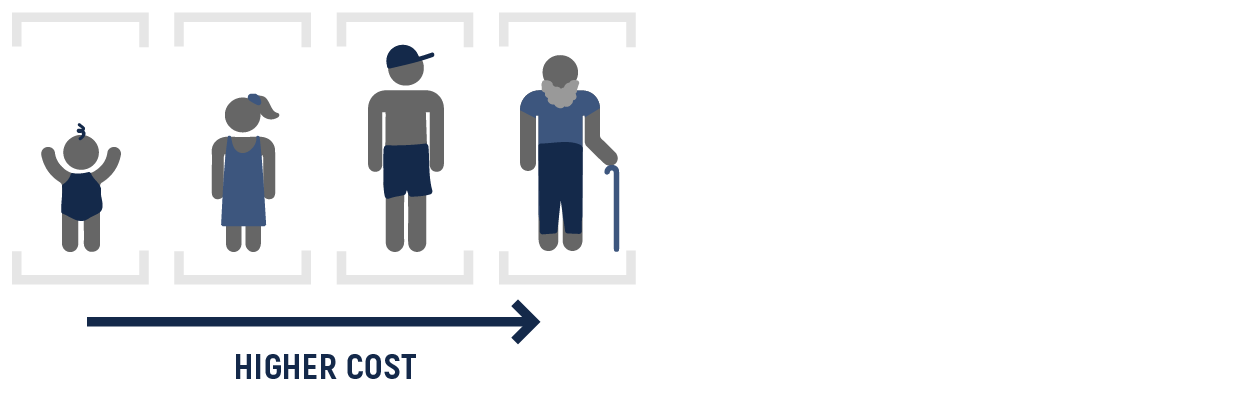

Age

In general, the older you are the higher price you should expect to pay for travel insurance.

Why? Because the number one factor in determining travel insurance pricing is trip cancellation coverage – and it’s just a reality that the older you are, the more likely you may be forced to cancel your trip.

It’s not a sliding scale, where a 37-year-old pays a little bit more than a 36-and-a-half-year-old. Instead, there are often age bands based on where the insurance company sees shifts in claim volume and/or claim amount.

Not every company has the same number of age bands, or defines them the same way. Make sure you compare plans and are comfortable not only about what you are paying, but what you are getting.

Trip Cost

This one’s simple. Expensive trips cost more to insure than less expensive trips.

However, trip cost is based on what you state are the prepaid, nonrefundable trip expenses you need to insure. So an all-totaled expensive trip without a lot of prepaid expenses might actually have a lower trip cost listed to insure, thus a lower policy cost.

Trip cancellation makes up a big part of most companies’ claims. A trip where the upfront cost is extremely high means the company would have to reimburse more if that trip were cancelled.

So it makes sense to charge more to cover that trip.

Plan Type

Basic plans are cheaper than luxury plans because they provide lower coverage limits. For example they often provide lower medical, medical evacuation and baggage limits.

However, the price difference between a less expensive plan and a more expensive plan may not be as great as the difference in coverage between the two plans. So compare a couple plans for your vacation protection.

Even if you don’t think you need more coverage, often it makes sense to get a quote on a basic plan and a more expensive plan, just to see how much more coverage the more expensive plan provides for the price.

You might be surprised at how affordable additional trip protection can be.

Optional Coverage

Often during the travel insurance quote process you’re given the option to buy additional coverage, or add-on coverage, and you’ll be shown the cost of those optional coverages.

These coverages can give you a lot of extra peace of mind – in the form of Cancel For Any Reason or rental car collision coverage – for an additional amount of premium.

For instance, with BHTP car rental collision coverage, when available, often costs around $10 a day.

Not only do optional coverages provide extra protection at a reasonable cost, they let you truly customize your plan to meet your travel needs.

Number Of Travelers

A single travel insurance policy can cover multiple family members on the same trip. However, each traveler has their own premium. Families traveling with children can also benefit from a family plan like ExactCare® where there is family-friendly pricing of 2 children for every 1 insured adult.

Trip Length

When you look at how much travel insurance costs for one week versus how much it costs for a month, there’s a big difference.

The longer the trip, the greater the chance something might happen – right?

Right. And that’s just part of it.

Longer trips tend to be more expensive trips taken by older travelers to more exotic destinations, often with many people covered under one policy.

You can see how these factors add up.

The Value More Than Justifies The Cost

Regardless of how much a trip insurance plan costs, its value to you will be determined when you need it.

When a travel emergency strikes and travel insurance helps pay your medical bills, evacuate you, or deal with the myriad of hassles involved with interrupting a trip and getting you back home, it can more than justify its cost.

If that makes sense and you’d like a quote from Berkshire Hathaway Travel Protection, we’ve made that easy. Just click below.