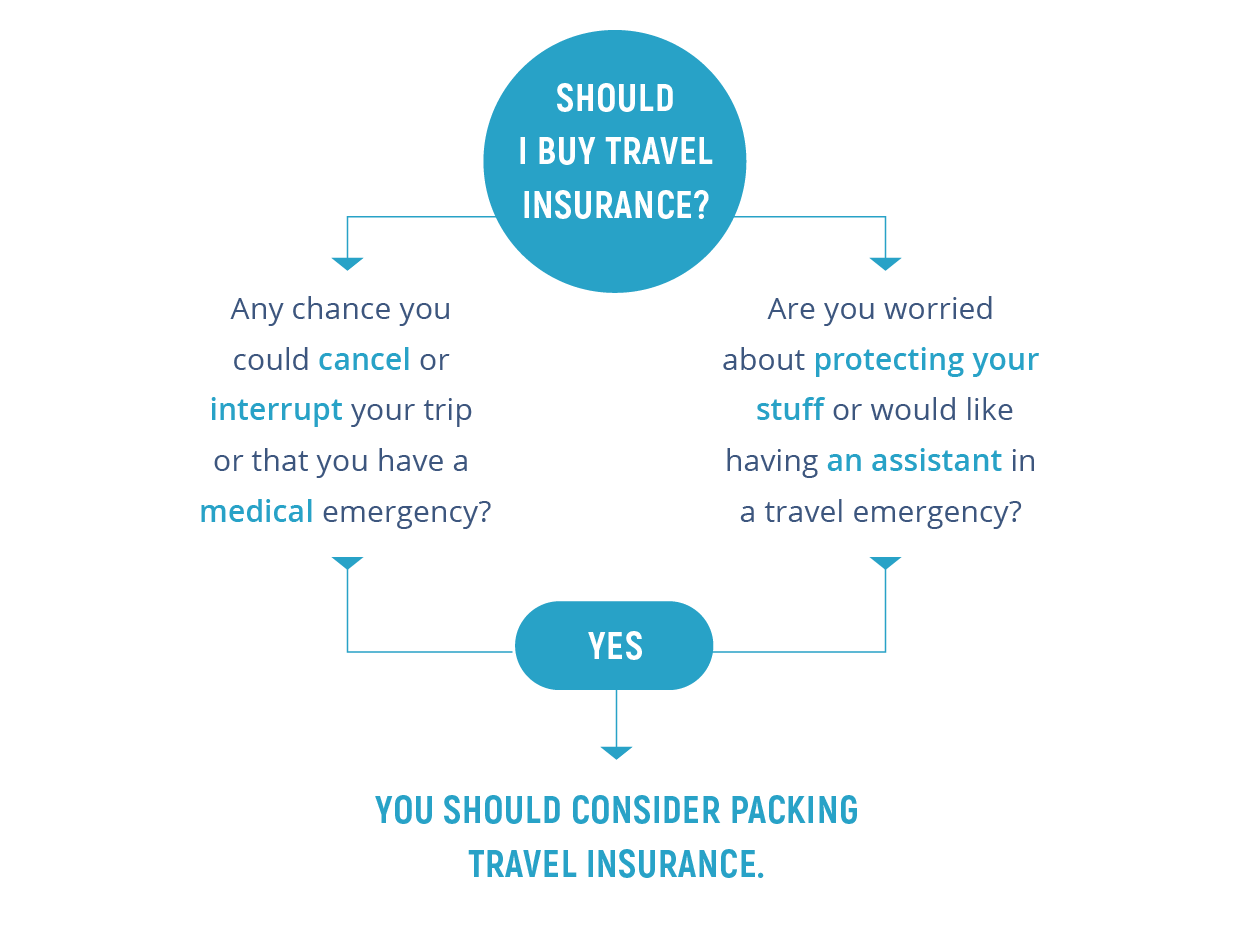

If you’ve ever wondered, “Should I buy travel insurance?”, look at where you’re going, how you’re getting there, and how much you’re spending on your trip. Let’s take a closer look at who travel insurance is built for – and why it’s built the way it is.

Chapter 4: Should I Buy Travel Insurance?

Why You Should Buy Travel Insurance

You should consider buying travel insurance if:

- You’re worried about something happening at your destination

- You’re afraid something might happen that would make you cancel or interrupt your trip

- You’re not sure what you’d do if you had a medical emergency while you were traveling

- You want to protect your belongings from loss, damage, or theft

- You want travel help ready and waiting in a travel emergency

Travel Insurance Has Something For Everyone

Travel insurance has something to help nearly every sort of traveler on nearly every sort of trip.

However, before you make that decision you need to consider:

Let’s take a closer look at each of those areas.

Your Traveler Type

It’s not just being an older traveler versus a younger one, male versus female, or a wandering nomad versus a tour-bus type. There are multiple traveler types, and travelers need travel-insurance that best fits their vacation needs.

Older Travelers

No matter how healthy you are, older travelers are more susceptible to medical emergencies than younger travelers. In addition, older travelers tend to take longer, more involved, more expensive trips.

However, even for short trips or trips with low upfront trip costs – like a road trip – travel insurance can be valuable for older travelers for its ability to help pay for emergency medical expenses.

And here’s one more great thing about travel insurance for older travelers: Its emergency travel assistance can help deal with issues that crop up along the way.

So in case you missed all that, if you’re an older traveler, here’s why you need travel insurance:

- You’re more susceptible to unexpected medical issues

- You tend to take longer trips

- You invest more in your travel experiences, because you’ve earned it!

- Travel assistance provides help along the way

Solo Travelers

If you’re a solo traveler, you need backup – and travel insurance can provide the backup you need:

- If you have a medical emergency

- If you require evacuation

- If you need emergency travel assistance – even if you can’t use a phone

Medical coverage that protects you when you travel abroad is a must-have if you’re traveling solo.

For solo travelers who like to wander off the beaten path, the emergency medical evacuation coverage in most travel plans is an important lifeline.

And finally, the travel assistance that comes with most plans is the perfect support system for many solo travelers.

Some insurers support multi-channel assistance requests, so even if you can’t call in you can still get help via email or social media.

Family Travelers

With family travelers’ complex lives, trip cancellation and interruption become even more important components of a travel insurance plan.

Trip cancellation and interruption can protect a family vacation in case the unexpected happens, like a child becomes sick, a parent loses their job, or an older relative passes away and you must now cancel your vacation.

And if you’re thinking travel insurance is only for international trips, it can also reimburse you for prepaid, nonrefundable expenses like:

- Hotel reservations

- Theme-park tickets

- Aquarium admissions

- Boat tours

Where You're Going

There’s an old rule of thumb: The longer it takes to get to a destination, the more that trip needs travel insurance.

It’s true that trips to far-flung destinations need to be insured – but trips close to home can benefit from travel insurance, too.

Going Far, Far Away

If you have to interrupt your trip a long way from home, it can be a challenge arranging things to get you back home – and a real hit to the wallet paying for those changed arrangements.

Travel insurance can help on both counts. Many plans may help you pay for a return flight home, in addition to reimbursing you for remaining prepaid trip expenses that you won’t be there to enjoy.

The travel assistance included with many plans can also help you quickly arrange your return home, so you’re not left to figure out all the changes on your own.

Sticking Close To Home

Even a domestic trip can have its share of issues.

If you have a medical emergency, for instance, it really doesn’t matter if you’re in Poland or Poughkeepsie. You need help fast, and you need bills paid. Travel insurance can help with that.

And think of once-in-a-lifetime trips like a destination wedding or honeymoon. Those trips need the comprehensive protection of travel insurance, in case a fire destroys that secluded mountain getaway or a freak April blizzard grounds all the flights.

How You're Getting There

Travel insurance is especially important for trips that involve transportation on a “common carrier” – a scheduled flight, cruise, bus, or train.

If something throws your scheduled transportation off its schedule, your schedule could be thrown for a loop.

How Travel Insurance Can Help

Travel insurance may help reimburse you for activities you miss because of a common-carrier delay, and travel assistance can help you rebook and reschedule.

If you’re flying, ExactCare Extra® has a suite of flight inconvenience benefits plus traditional comprehensive coverages like trip cancellation, interruption, medical emergencies and more.

On the other hand, if you’re taking a road trip ...

- Trip cancellation and interruption can help pay back money you paid up-front for activities or accommodations.

- Optional rental-car collision coverage can help if you have a fender-bender in Fort Worth or get T-boned in Tonopah.

What You're Spending

The more your trip costs, the more you usually need travel insurance. Some smaller getaways might have a lower risk of losing nonrefundable deposits, while many big-ticket trips carry the potential for significant financial losses.

For example, maybe you can get away with not insuring a $100 hotel room or a $99 flight from St. Louis to Louisville. But can you afford to cover the entire cost of a $30,000 Antarctic cruise if you get sick and have to cancel your trip?

Any Extenuating Circumstances

Extenuating circumstances?

Sure. Anything unexpected that might happen when you travel could be considered an extenuating circumstance. For example:

- You’re worried about potential disruptions from terrorism, and you want to be covered if there’s some sort of qualifying event when you reach your destination. Many plans may let you interrupt your trip and return home in that situation.

- Your tour operator goes out of business without notice or warning. Many plans have coverage for just such an occurrence.

- You just feel better when your trip is insured. That’s absolutely legit, and a great reason to buy travel insurance.

Find Out How Much Protection Costs

To find out how much it costs to avoid these issues, take a few minutes and get a quote. It’s easy, and there’s absolutely no obligation.