Get Your Free Cruise Travel Insurance Quote Now

All fields are required.

Compare Cruise Travel Insurance to LuxuryCare

WaveCare®Comprehensive travel insurance for those who choose to cruise | LuxuryCare®Comprehensive travel insurance + with our highest coverage levels | |

|---|---|---|

| Coverages | ||

| 100% of Trip Cost | 100% of Trip Cost | |

| Provides reimbursement for non-refundable trip payments if you have to cancel a trip due to a covered reason such as; injury, illness, or death of you, your traveling companion, a family member, or other covered unforeseen events. Please read the plan’s Description of Coverages for complete details. | ||

| - | Available | |

| Provides reimbursement for up to 50% of your non-refundable trip payments if you have to cancel a trip for any reason not listed in the Description of Coverages. CFAR is only available on LuxuryCare, for trips up to $10,000 per individual, and only if you are purchasing your travel insurance plan within 15 days of your initial trip deposit date. Must be added at time of purchase. CFAR cannot be added after purchase of a LuxuryCare plan. Please read the plan’s Description of Coverages for complete details. | ||

| 150% of Trip Cost | 150% of Trip Cost | |

| Provides reimbursement for non-refundable trip payments if you are already on your trip and experience a covered unforeseen event that forces you to return earlier than planned. ExactCare Lite covers return transportation only. Please read the plan’s Description of Coverages for complete details. | ||

| $75,000 | $150,000 | |

| Provides reimbursement for emergency medical expenses if you suffer an injury or sickness while on your trip. All plans provide primary medical expense coverage, except ExactCare Value which is secondary. Primary coverage means your travel insurance pays first, and you are not required to first submit a claim to your individual health insurance plan. Includes some dental coverage. Some plans vary by state. Please read the plan’s Description of Coverages for complete details. | ||

| $750,000 | $1,000,000 | |

| Covers reasonable and customary charges for an emergency medical evacuation incurred for an injury or sickness that occurs while on a trip. Please read the plan’s Description of Coverages for complete details. | ||

| $1,500 | $2,500 | |

| Covers your luggage, personal items, and documents. Please read the plan’s Description of Coverages for complete details. | ||

| $1,000 | $2,500 | |

| Provides reimbursement for reasonable additional covered expenses such as lodging, local transportation, and meals if your travel is delayed beyond a defined number of hours. Please read the plan’s Description of Coverages for complete details. | ||

| $500 | $1,000 | |

| Provides reimbursement for additional travel expenses if you miss a connecting flight due to a covered reason such as inclement weather or a common carrier caused delay. Please read the plan’s Description of Coverages for complete details. | ||

| - | - | |

| Pays you when your delay exceeds two hours on the tarmac. Please read the plan’s Description of Coverages for complete details. | ||

| - | - | |

| Pays you when your flight is delayed more than two hours from its scheduled gate departure. Please read the plan’s Description of Coverages for complete details. | ||

| $500 (Fixed) | - | |

| Only available on WaveCare. Includes: Cruise Disablement if you are confined to your cruise ship for a covered reason; Cruise Diversion if your cruise does not stop at a scheduled port of call for a covered reason; and River Cruise Diversion if your river cruise is unable to set sail for a covered reason. Please read the plan’s Description of Coverages for complete details. | ||

| $200 | $500 | |

| Provides reimbursement for essential items when your luggage is delayed by the airline for a certain amount of time. Please read the plan’s Description of Coverages for complete details. | ||

| - | - | |

| Similar to baggage delay, this provides reimbursement for rental or replacement of your sporting equipment that has been delayed by the airline for a specified amount of time. Please read the plan’s Description of Coverages for complete details. | ||

| $10,000 | $25,000 | |

| Pays you for an accident that results in the loss of life, limbs or sight. Please read the plan’s Description of Coverages for complete details. | ||

| $35,000 | $35,000 | |

| Available for purchase as an upgrade on certain BHTP plans. Provides reimbursement for repairs if your rental vehicle is damaged due to collision, vandalism, windstorm, fire, hail or flood. Eligibility varies by state and destination. A deductible may apply. Please read the plan’s Description of Coverages for complete details. | ||

| Included | Included | |

| You have 24-hour access to a service team that can help in a medical emergency (e.g., locating a doctor, hospital or pharmacy), travel emergency (e.g., finding alternative flights, last-minute hotel changes or car rental assistance), or simply obtain concierge assistance for non-emergency requests (e.g., restaurant reservations, theater or event tickets). Costs of the services are the responsibility of the insured if not covered under the policy. | ||

| Included | Included | |

| When this is listed as “Included,” the exclusion of pre-existing medical conditions is waived as long as you meet all criteria outlined in your Description of Coverage. Please read the plan’s Description of Coverages for complete details. | ||

| Included | Included | |

| When this is listed as “Included,” the plan covers financial default of an airline, cruise line, common carrier or tour operator as long as you meet all criteria outlined in your Description of Coverage. Please read the plan’s Description of Coverages for complete details. | ||

| Included | Included | |

| When this is listed as “Included,” the plan covers cancellation for work reasons as long as you meet all criteria outlined in your Description of Coverage. Please read the plan’s Description of Coverages for complete details. | ||

WaveCare®

Comprehensive travel insurance for those who choose to cruiseLuxuryCare®

Comprehensive travel insurance + with our highest coverage levelsCruise Travel Insurance Protects Your Investment ... And You.

WaveCare® from Berkshire Hathaway Travel Protection is easy, full-featured cruise trip insurance, specially designed for cruise related issues listed below.

With all these issues, you can count on:

- Quick quotes: Get covered in as little as five minutes

- Clear coverage: Receive coverage details in clear, easy-to-understand language

- Easy claim submissions: File most claims in seconds, with just a picture from your phone – and without piles of forms

- Fast payments: Get your claims paid up to five times faster than industry averages*

- Help when you need it: Count on 24/7 emergency travel assistance

Cruise Insurance: Why It’s More Than Just Travel Insurance

Whether you’re cruising for the first time or have multiple cruises under your belt, you probably know that travel insurance is a must-have.

However, you might not know that there’s something even better than travel insurance for a cruise: Cruise travel insurance – travel insurance designed specifically for cruises and the people who take them.

To help you understand how cruise insurance is different from travel insurance, we’ve split this page into three parts. If you want a quote at any point, just click Get A Quote button at the top right-hand corner of the page.

- Cruise insurance vs. travel insurance

- Buying cruise insurance: Cost, coverages and providers

- Cruise insurance FAQs

1. What is cruise insurance (and why is it different from travel insurance)?

Travel insurance covers many types of mishaps that can occur while traveling. Cruise insurance does that and more specific to what could happen on a cruise vacation. Cruise insurance is custom-built to provide door-to-ship-to-shore-to-door coverage against virtually anything that might go wrong on a cruise vacation.

Some of these coverages aren’t found in other insurance policies (including insurance offered by many cruise lines!) These coverages include:

Medical emergencies

Cruise ships are essentially floating cities with really expensive medical care. Doctors, X-rays, and medicines all can cost up to 10 times what you might pay on shore – and your health insurance plan may only cover a very small part of it, or may not cover any of it at all.

Because of that, when a medical emergency strikes:

- Treatment is expensive; and

- Your standard medical plan probably isn’t going to cover it.

This applies whether you get sick onboard, you get injured on an excursion, or you simply forget your prescription.

You need emergency medical insurance for a cruise – the more the better. Look for higher policy limits, because without them, you may be facing big medical bills that your regular health insurance may not cover.

Example: There are no definitive statistics or listed pricing on cruise ship healthcare costs, but expect to pay $100-$150 for an office visit or an X-ray. Costs could easily exceed $1,500/day for further medical treatment.

Emergency medical evacuation

The cost of getting airlifted off of a cruise ship for additional medical treatment can easily hit six figures.

A low-cost travel insurance policy might not have high enough limits to cover the full cost of a medical evacuation from a cruise ship. That’s why cruise insurance has higher limits for these emergencies.

Example: USA Today put the cost of a basic medical evacuation at the following:

Trip interruption

Trip interruption may cover you in case you have to interrupt your trip because of an issue such as:

- You need to return early because of the health of someone on the trip or back home.

- You must return home early for covered work reasons such as a merger or disaster

- You must return home early for covered reasons such as your residence being made uninhabitable from a natural disaster or burglary

Or, what if your cruise ship’s arrival at the final port of call was delayed causing you to miss your flight home? Or mechanical issues caused the cruise to be cut short and you’re stuck finding alternative accommodations on shore or an earlier return flight home?

Find the list of covered reasons for cancellation and interruption and read it thoroughly. Understand the allowed circumstances for interrupting a trip.

Example: The average cost of a cruise covered by WaveCare in 2022, factoring in only prepaid expenses, is $161 per person per day. Leaving a 10-day cruise after three days could cost you $1,127 per person. Add that for each traveler, and you could be out thousands of dollars if you don’t protect your cruise vacation.

Flight delays and missed connections

What happens if you can’t get to your cruise because of a flight delay or missed connection?

Airlines are only obligated to honor a flight ticket to a destination and reschedule a passenger to that original destination on the next available flight. For many, this could be the next day or days, forcing travelers to pay for hotel, ground transportation, extra meal expenses. What about getting caught up with your cruise?

Cruise insurance can help cover unexpected expenses if you have a flight delay or missed connection, as well as help you catch up with your departed cruise if you were delayed or missed a connection for a covered reason (not just I sat at the airport bar too long and missed my flight).

Plus, your cruise travel insurance could include emergency travel assistance which will coordinate with the cruise line and airlines serving the region to reconnect you with your cruise at the next port of call.

Example: If you miss a connection and can’t catch up to a seven-day cruise, depending on where your cruise is going, you could be out anywhere between $1,500 to upwards of $5,000 per person in prepaid expenses. And that’s just the cruise costs. There could be additional losses for any pre- or post-cruise expenses as well.

Lost luggage

Luggage doesn’t get lost often on a cruise, but when it does it’s a major hassle. That’s why you should always choose the maximum dollar coverage for lost luggage.

In terms of what’s covered, compare your plan’s luggage coverage to our ultimate cruise packing checklist and see how you fare.

Since delayed luggage is more common than lost luggage when taking a cruise, check out the coverage for luggage delay as well. You want coverage that reimburses you for essentials if your luggage is delayed and the cruise is departing.

Finally, see how quickly you can be reimbursed. Reimbursement for replacement items isn’t very useful if it arrives two weeks after your cruise ends.

Example: Replacing lost items could cost thousands of dollars. Even buying replacement items like swimsuits and personal items from the ship’s gift shop can cost hundreds of dollars.

Cruise-specific coverages

Cruise line financial default

If you think your cruise line won’t go bankrupt while you’re cruising, you’re probably right. However, it has happened before, most recently in 2022.

If you believe that the surest way of having something happen to you is to say, “It’ll never happen to me,” being covered for the financial default of a cruise line is a good idea.

Example: In 2022, Crystal Cruises declared bankruptcy, leaving creditors and travelers out more than $100 million in bills and deposits on cruises5.

Cruise ship disablement

You’ve probably heard of cruise-ship disablement, because when it happens, as in the case of the Norwegian Escape in March 20221, it generally makes the news.

When a cruise ship runs aground or loses power, that’s like an entire city being thrown up on the rocks or going black.

Getting things right often means getting everyone off of the ship – and evacuation is likely to be difficult and/or risky.

Cruise insurance with coverage for cruise ship disablement pays you for your inconvenience, and helps you make alternative arrangements.

Example: In 2019, passengers had to be rescued by helicopter after the Viking Sky’s engines failed off the coast of Norway2. It’s not an isolated incident. In 2022, the Norwegian Escape ran aground in the Dominican Republic3.

Cruise ship diversion

Equipment issues or bad weather can cause cruise lines to divert cruises from their intended course. When that happens, ports of call can get missed, cruises can lengthen or shorten, excursions can be canceled, and more.

In those situations, any sort of coverage is welcome. WaveCare offers an inconvenience payment for travelers whose cruises have been significantly diverted.

Example: In 2022, low water levels on the Rhine caused passengers to endure ship swaps, bus transfers and skipped ports of call6. Also in 2022, a Caribbean cruise ship diverted to the Bahamas to avoid having its officers arrested for unpaid fuel bills7.

Prepaid excursion cancellation

If you’ve paid for a special excursion on your cruise and it gets canceled, are you out the cost of that excursion?

Not with cruise insurance. Prepaid excursions should be added to the total cost of your trip when you book your travel insurance. Cruise insurance can protect those non-refundable expenses and may reimburse you what you paid for the excursion – so while you might not get to sail on an America’s Cup yacht, at least you won’t lose the money you paid.

Example: Onshore excursions can cost $50-$300 per person – with payment in advance.

Loss of important documents

If you lose your passport or other important travel documents while on a cruise, it can be a major inconvenience, mainly because the ship keeps moving.

Fortunately, cruise insurance with 24-hour emergency travel assistance can help you secure new travel documents, wherever in the world you happen to be … even if you’re in the middle of the ocean!

Example: According to the U.S. Embassy in Italy, you can get a replacement passport in around a day – but if you’re traveling or don’t have a copy of your birth certificate and a passport photo, that time can lengthen considerably.

2. Buying cruise insurance: cost, coverages and providers

Now that you know you need insurance to cover the problems that can occur on cruises, let’s explore cruise insurance’s cost, coverages, and providers.

Step 1: Align the cost with the coverages

Cruise insurance usually costs less than 10% of your total trip cost. The price you pay is determined largely by:

- Your cruise length

- Your cruise costs

- Your age

- The number of people covered under the plan

As pointed out earlier, while cruise insurance is designed to be a good fit for most cruises, the differences between cruise insurance and travel insurance are modest.

And there may be circumstances when a different plan is a better idea.

Multiple plans within the Berkshire Hathaway Travel Protection product line can cover your cruise, but some will be a better fit based on the exact particulars of your trip. For instance:

Budget cruises

If you got a great deal on a cruise, you’re taking a short cruise, or you have a limited budget after paying for your cruise, WaveCare may not be the best fit.

For instance, you may not need $750,000 in emergency evacuation coverage and 150% coverage for trip interruption for a four-day Jamaican cruise.

In those instances, consider ExactCare Value®. It covers the things it should without putting undue strain on your wallet.

Adventure cruises

If you’re taking a lot of your own gear on a cruise – if you’re doing a lot of scuba diving during excursions, for instance, or if you’re taking special clothing or equipment on an Antarctic cruise – WaveCare’s luggage benefit may not be a perfect fit.

For adventure cruises, consider AdrenalineCare®. Its additional baggage coverage, coverage for sporting equipment delay, and extreme sports coverage may align better with your active cruise.

Luxury cruises

For a lengthy, expensive cruise with lots of shore excursions, LuxuryCare® may be a better option.

The longer your trip the more you pack, so LuxuryCare has additional coverage for baggage as well as special coverage for sporting equipment.

And because your chances of a medical emergency go up the longer you’re gone, LuxuryCare has enhanced medical and evacuation coverage.

When you get a quote with Berkshire Hathaway Travel Protection, you’ll be presented with coverages and costs. Align those with the type of cruise you’re taking, and you’ll find your perfect cruise insurance plan.

Step 2: Choose the right coverage amounts

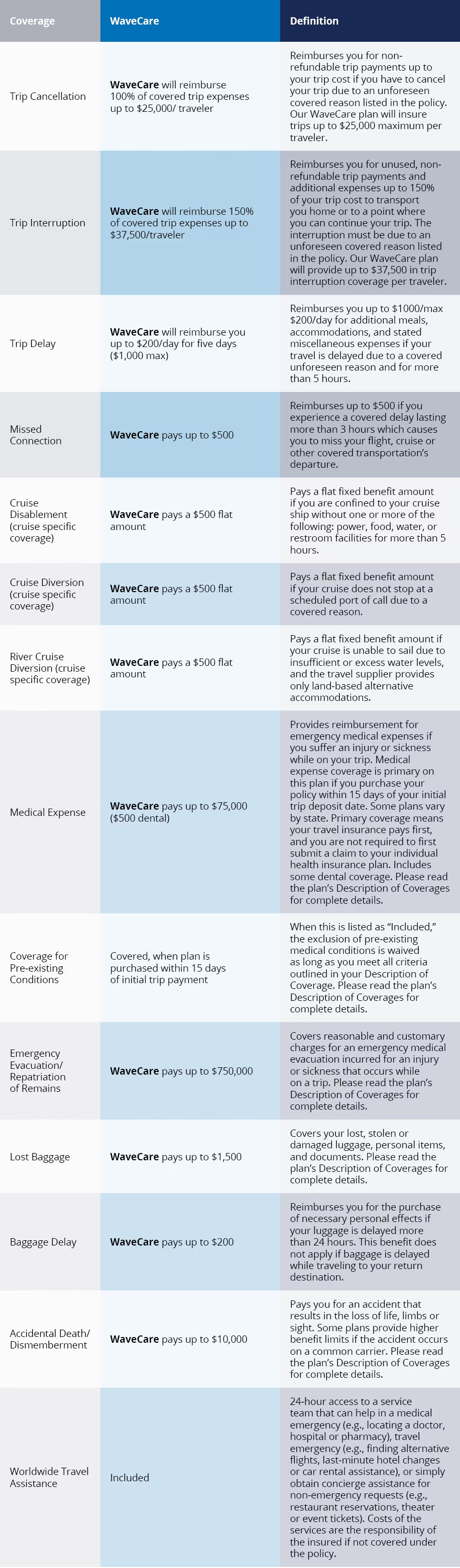

As you compare coverages, it’s important to know what’s included. While nothing is as definitive as reading your policy, this table will help you understand the basics of important coverages, and how cruise insurance covers them.

Here we're using our WaveCare cruise insurance coverage as an example. Please always read the plan’s Description of Coverages for complete details.

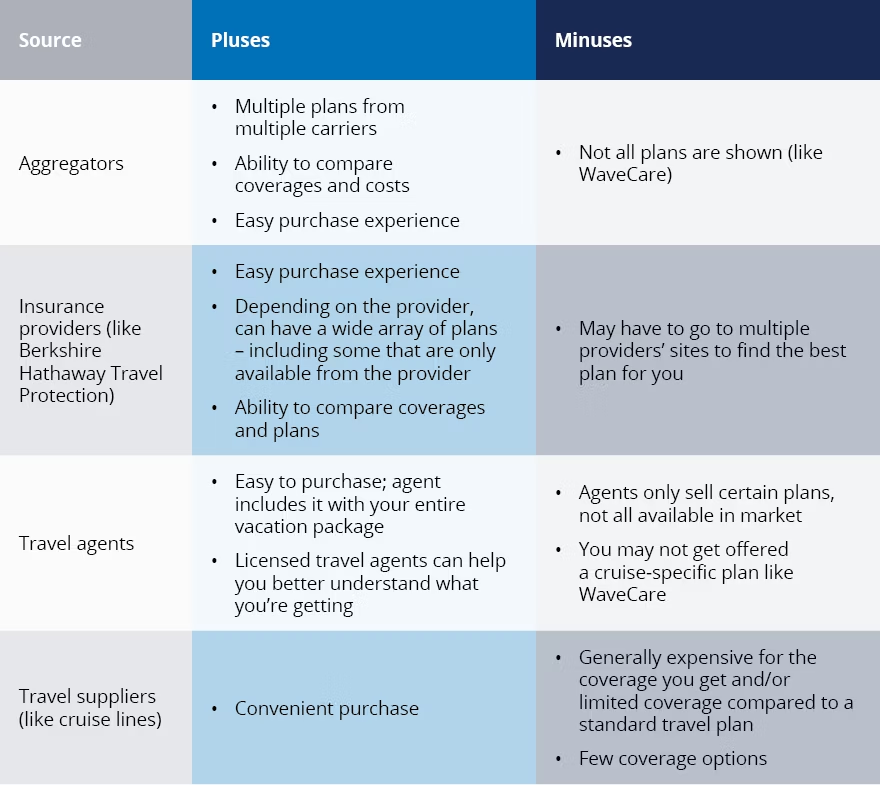

Step 3: Choose the right cruise insurance provider

You can buy insurance for a cruise from many places, like:

- Insurance providers

- Aggregators

- Travel agents

- Cruise lines

Here’s how they stack up.

Wherever you shop, when evaluating coverage for your cruise, ask yourself the following:

Does it have cruise specific coverages? Does it cover cruise ship disablement, for instance?

Does it have high coverage levels for the types of mishaps that might occur on a cruise? Those include:

- Weather-related issues that cause cancellation or interruption

- Medical emergencies that may require evacuation

- Lost or delayed luggage

- Flight issues that cause you to miss your cruise

Because these issues are severe, and their severity is multiplied because they’re taking place on a floating city, you need a plan that has the highest dollar amount of coverage for these issues, or the broadest range of covered circumstances.

If you’re on a budget, you may need to weigh the cost of a comprehensive policy against the cost of your cruise.

You also need to weigh the convenience of buying insurance from a cruise line as you’re booking against the oftentimes greater value (and better coverage) that comes with buying from an insurance provider directly or aggregator after booking.

The most important thing about buying cruise insurance is that you cover your cruise. The next most important thing is getting the coverage your specific cruise requires at the best possible price.

3. Cruise Insurance FAQs

It’s natural to have questions about the best cruise insurance for your trip. Here are some of the questions travelers most often ask.

What is cruise insurance?

Cruise insurance is travel insurance that provides coverage that’s especially important for cruises, such as:

- Cruise interruption and cancellation

- Cruise ship disablement

- Medical emergencies

- Emergency evacuation

If you're planning a cruise, consider cruise insurance to protect your investment and provide peace of mind.

When you do, start at the beginning – with cancellation coverage. This will help reimburse you for non-refundable expenses if you have to cancel your trip due to a covered, unforeseen event like a medical emergency or a natural disaster.

Cruise interruption coverage will do the same if your cruise is cut short for a covered reason.

Emergency medical coverage is important because of the cost of shipboard medical care, and the fact that most shipboard doctors and foreign medical care is out-of-network.

Travel health insurance can help cover the cost of treatment if you become ill or injured during your trip, and it often includes emergency evacuation coverage if you need to be transported to an onshore medical facility.

Just remember that pre-existing medical conditions aren’t automatically covered. Read your policy to see if they’re covered, and under what circumstances.

That’s a good reminder to carefully review any cruise insurance policy to understand what is and isn't covered, as well as any exclusions or limitations.

Some cruise lines may offer their own insurance policies, but it's always a good idea to compare those policies to other options to ensure you're getting the best coverage and value for your money.

When do I buy cruise insurance?

You can buy cruise insurance right up until your departure date, but the sooner you buy it, the more likely you are to qualify for additional protections.

When’s the best time to buy cruise insurance? It’s long before you pack. It’s even long before you prepare your packing list.

The best time to buy cruise insurance is when you’re making your first payments on your cruise.

Why? The most important reason why is because you can qualify for bonus coverages.

With Berkshire Hathaway Travel Protection, when you buy cruise insurance within two weeks of making your initial trip deposit, you’re eligible for coverage for pre-existing conditions. Other providers may provide similar benefits.

If you buy WaveCare, BHTP’s medical coverage is primary, meaning it pays your bills before any other medical insurance.

There are other reasons, too. If you insure your cruise right away, it’s done. Cross it off the list.

Also, the sooner you buy your cruise insurance, the sooner you’re protected for things like trip cancellation.

There are lots of great reasons to buy travel insurance right away, but getting more coverage for the same premium is huge.

How to buy cruise insurance

Buying cruise insurance can give you peace of mind. Making sure you get the right coverage starts with understanding your needs and considering your options. After that, it’s a matter of understanding how your coverage works and how claims are paid.

With the right cruise insurance coverage, you can enjoy your vacation without worrying about unexpected cancellations, medical emergencies, or lost baggage.

How do you make sure you get the right coverage? Here’s how to buy cruise insurance so you’re confident you’re really covered:

- Consider your needs. Think about what coverages you really need. For example, if you have a pre-existing medical condition, make sure medical expenses are covered for your condition, and you can be reimbursed if you have to cancel or interrupt your trip because of your condition.

- Research your options. Lots of plans can cover cruises, so it's important to understand your choices. You can evaluate options online, at the site of a travel insurance provider like Berkshire Hathaway Travel Protection or an aggregator like InsureMyTrip or Squaremouth.

- Read the fine print. Before you buy, understand what your policy covers, under what circumstances, and to what dollar amount. Pay attention to coverage limits, deductibles, and any exclusions.

- Buy early. It's a good idea to purchase cruise insurance as soon as you book your trip. You'll often qualify for bonus coverage, and you know you’ll be covered if you need to cancel for a covered reason before departure.

- Choose a plan from a provider with a high claims satisfaction rating, and understand the claims process. Knowing the claim submission process and having all documentation for things like luggage contents can save time when you need it most.

By following these tips, you can find the right cruise insurance policy for your needs and enjoy your vacation with peace of mind.

Where to buy cruise insurance?

Travelers have several options to choose from when buying cruise insurance:

- Travel insurance companies

- Aggregators that offer a variety of policies from different providers

- The cruise lines themselves

Deciding where to buy cruise insurance can be difficult, with lots of options for travelers, each with its own advantages.

One option is to buy cruise insurance from a travel insurance provider.

Companies like Berkshire Hathaway Travel Protection offer a range of policies with varying coverage levels – including cruise-specific insurance, in BHTP’s case. Compare options to find the policy that best suits your needs.

Aggregators like InsureMyTrip and Squaremouth offer a range of policies from different providers, so travelers can compare and choose the policy that best suits their needs.

Many cruise lines offer their own insurance policies that cover a range of issues, from trip cancellation to medical emergencies. While this can be convenient, cruise line policies may not offer as much coverage as policies from the actual travel insurance providers.

It's important to examine any policy before buying cruise insurance, regardless of where you buy it. Read the fine print and understand exactly what is and isn't covered, as well as any exclusions or limitations.

Taking the time to carefully choose the right policy can pay off with a more stress-free vacation.

Do you need special travel insurance for a cruise?

Buying travel insurance specifically designed for cruises is a good idea. Standard travel insurance may not cover aspects of a cruise like cruise-ship disablement or financial default of a cruise line. Cruise-specific insurance provides coverage for these situations and more.

When considering travel insurance for a cruise, review the policy carefully to ensure it’s covering all aspects of your trip.

Some policies may only cover the cruise itself and not any pre- or post-cruise travel arrangements. Others may have exclusions for activities like scuba diving or other adventure sports you plan to do on excursions.

One of the main benefits of cruise-specific insurance is coverage for cruise ship disablement. If a cruise ship runs aground or loses power, the insurance can provide reimbursement for the inconvenience.

Another important aspect of cruise insurance is medical coverage. While most cruise ships have medical facilities on board, the cost of treatment can be expensive – and out-of-network on most health insurance plans.

Cruise insurance can cover medical emergencies that occur at sea, as well as evacuation to a hospital on land.

In addition, cruise insurance can cover trip cancellation or interruption, lost or delayed baggage, and emergency assistance.

While cruise-specific insurance isn’t required, it’s highly recommended to make sure all aspects of the trip are appropriately covered.

It’s also important to compare policies and carefully review coverage details, and choose the best option for your specific cruise.

Is cruise insurance worth it?

A cruise is one of the largest travel investments many travelers make. As a result, travelers often feel that the peace of mind cruise insurance offers is more than worth the price they pay.

For travelers who have a claim or need assistance, cruise insurance is invaluable in helping with daunting travel emergencies like illness, medical evacuation, or trip interruption.

Think about being airlifted off of a cruise ship or having to interrupt your cruise on some tiny island, with limited options for returning home.

Or think of something simpler, like having your luggage lost or delayed and being left without clothes and personal items.

Cruise insurance can help in all these cases, and the travel assistance that comes with cruise insurance plans from Berkshire Hathaway Travel Protection can help make the necessary arrangements when emergencies change travel plans.

Plus, cruise insurance can cover hundreds of thousands of dollars of cruise-related expenses like emergency evacuation, medical bills, cruise ship disablement, and costs related to cruise cancellation and interruption.

Cruise insurance’s ability to help in emergencies makes it a valuable and worthwhile purchase – and even if you don’t use it, cruise insurance gives many travelers priceless peace of mind.

No wonder the U.S. State Department recommends that Americans insure their cruises4.

You can learn more in our articles: Do you need special cruise insurance for a cruise? and Is cruise insurance worth it?

Does travel insurance cover cruises?

Conventional travel insurance covers cruises; however, it may not offer cruise specific coverages, or it may not provide the highest level of coverage for the types of mishaps that occur on a cruise.

The best travel insurance for your cruise is the plan that covers all the elements of your cruise – getting there, the cruise itself, any activities, and getting you home – most completely, with the highest dollar limits.

Choosing the right travel insurance plan for your cruise involves looking at your trip – where you’re going, what you’re doing, how long you’re going to be gone, and how much you’re spending.

For most cruises, cruise-specific insurance like WaveCare offers the broadest level of protection for the things that can go wrong during a cruise.

However, there may be certain circumstances and certain types of cruises – adventure cruises, for instance – where a plan with different types of coverage will be a slightly better fit.

In the case of that adventure cruise, you might want a plan like AdrenalineCare, with its additional gear coverage.

Finding the right travel insurance plan is all about covering as many eventualities as you can.

How much is cruise insurance?

Cruise insurance generally costs less than 10% of your total trip cost. This number can vary based largely on:

- Your cruise length

- Your age

- Your trip cost

- The number of people covered

Every cruise is different. It may start in a different place, visit different ports of call, and have a longer or shorter itinerary.

In addition, different family members – older and younger – may be on the cruise.

All of these things can affect the price you pay for cruise insurance.

The price of cruise insurance is based on how much risk the insurance company takes on in insuring your cruise. Risk increases:

- The longer you’re at sea

- The more your cruise costs

- The older you are

- The more people you cover under your policy

- The more things that are covered under your policy (or the higher the dollar limits for things that are covered)

When you get a quote for cruise insurance, the insurance provider asks you about these things, and uses your answers to come up with a price for your cruise insurance.

In general that price is around 8-10% of your total trip cost, but it can vary based on these factors and the plan you choose. That’s why you need to get a quote to learn the exact cost of cruise insurance.

See more in our article: How much is cruise insurance?

How late can I add cruise protection?

You can buy cruise travel insurance any time from right after booking your trip to 24 hours before your cruise departs.

There’s nothing wrong with being a last-minute traveler. You can get some great deals that way.

That’s especially true when it comes to cruises.

However, while it’s totally cool to be a last-minute cruiser, it’s not quite as neat to be a plan-ahead cruiser and a last-minute cruise insurance buyer.

It’s technically true that you can buy cruise insurance right up until 11:59 p.m. on the date of departure. You can be practically up the gangway and still be able to protect your cruise with cruise insurance.

But if you buy a Berkshire Hathaway Travel Protection plan like WaveCare within two weeks of making your final trip payment, you receive coverage for pre-existing conditions and for financial default.

In general, if you know you’re going to buy travel insurance for your cruise there’s no reason to wait. Buy it as soon as you can.

Not only does buying early let you cross travel insurance off your list, but you can qualify for bonus coverages.

See more in our article: When do I buy cruise insurance?

Cruise insurance – custom-built to protect your cruise

Cruise insurance is more than just travel insurance – it’s coverage custom-built to protect the people who take cruises … and every aspect of a cruise – from door to ship to shore to door.

With coverage for medical emergencies, trip interruption and cancellation, lost luggage and more, it’s what you need to give you travel peace of mind.

See What Our WaveCare Customers Have To Say

Excellent coverage and excellent claims service

“Due to airline delays we missed embarkation and joined our cruise several days later. When we returned home we filed a claim for the missed days and some additional expenses. To our surprise our claim was processed and paid within three weeks. Very impressive. We now use BHTP for all our travel insurance needs.”

—Raymond K.

Wavecare coverage

“I have been using BHTP for the last 10 years n love their coverage, customer service, prompt response time n courteous staff! I travel a lot n I feel protected knowing BHTP has my back! Ty for giving us the peace of mind n will continue to use their services for both mine n my family travel needs!”

—Shalini D.

Secure feeling

“I really like the cruise policy that I purchased. It made me feel secure throughout my journey.”

—Joseph Z.

Berkshire Hathaway ...

“Berkshire Hathaway has been very helpful with my cancellations and re-booking for future cruise”

—Carol O.

A Travel Insurance Company Backed By Experts

Berkshire Hathaway Travel Protection is a division of Berkshire Hathaway Specialty Insurance Company, which holds a financial strength rating of A++ from AM Best.